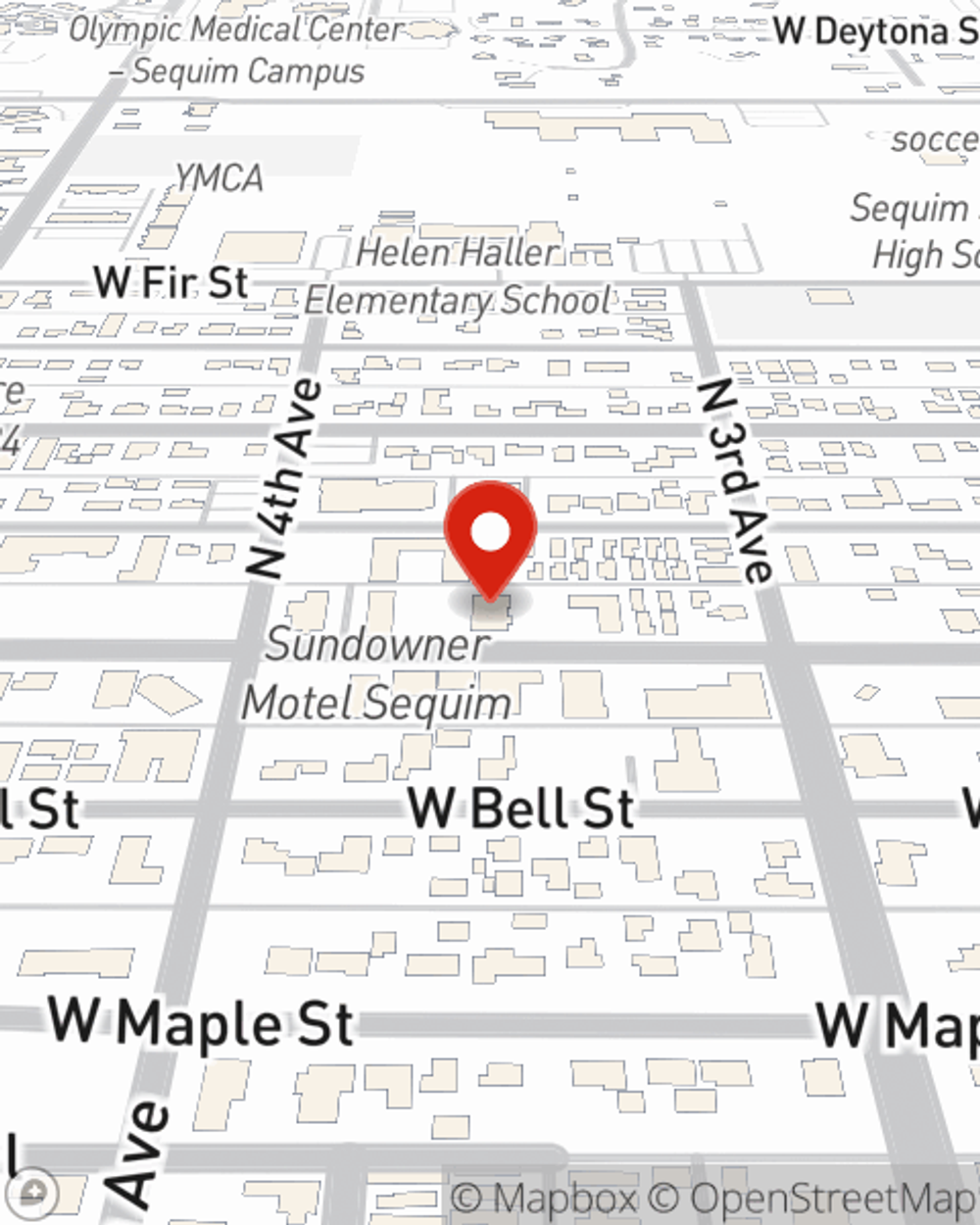

Business Insurance in and around Sequim

Sequim! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

- Sequim

- Port Angeles

- Port Townsend

- Clallam County

- Jefferson County

- Port Hadlock

Insure The Business You've Built.

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a home improvement store, a HVAC company, a toy store, or other.

Sequim! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Jon Jack. With an agent like Jon Jack, your coverage can include great options, such as commercial liability umbrella policies, business owners policies and artisan and service contractors.

Since 1935, State Farm has helped small businesses manage risk. Reach out to agent Jon Jack's team to review the options specifically available to you!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Jon Jack

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?